ZA Salary Schedule Form 2016-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

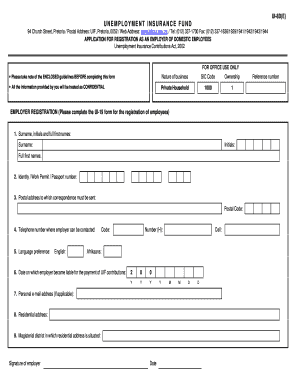

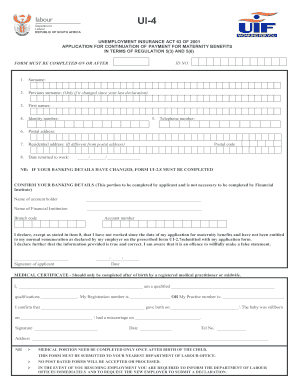

Understanding the Department of Labour Salary Schedule Form

What is the purpose of the salary schedule form?

The salary schedule form serves as a crucial document for recording employee remuneration, ensuring compliance with South Africa's labor laws and regulations. Proper documentation of employee salaries is essential for transparent financial practices within businesses, aiding in both compliance and budget forecasting.

-

Significance of documenting employee remuneration: It provides a clear record that can protect both employees and employers during audits or disputes.

-

Compliance with labor laws: Adherence to South African labor laws is vital to avoid legal repercussions.

-

Financial planning: Businesses can use salary schedules to budget effectively and ensure they are ready for payroll expenses.

What are the key components of the Department of Labour salary schedule form?

Each component of the salary schedule form is critical for accurate data entry and processing. Understanding these fields ensures that all necessary information is captured correctly, facilitating smoother operations within HR and payroll departments.

-

This field validates the identity of the employee, ensuring all records are legitimate.

-

Accurate naming conventions prevent confusion in record-keeping.

-

This is vital for tracking and reporting to the Unemployment Insurance Fund.

-

Essential for maintaining proper business records and legal compliance.

-

Defines the length of employment, which can affect remuneration calculations.

How should you fill out the salary schedule form?

Properly filling out the salary schedule form is essential for accuracy and compliance. Following a step-by-step guide can help prevent mistakes that could lead to legal complications or delays in processing.

-

Professionally document each employee’s information as indicated on the form to avoid errors.

-

Double-check all information for accuracy before submitting the form.

-

Use a confirmation checklist to validate the entries and ensure compliance.

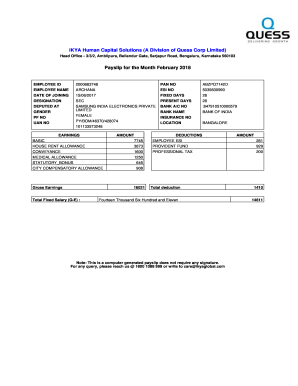

How are salary calculations made for remuneration and hours worked?

Calculating remuneration involves assessing not just the salary but also the hours worked. Understanding these calculations can help businesses in fair compensation practices.

-

Consider both base salary and any bonuses to arrive at the total remuneration.

-

Include all relevant hours, such as overtime, in your calculations.

-

Document any changes in remuneration due to promotions or performance reviews appropriately.

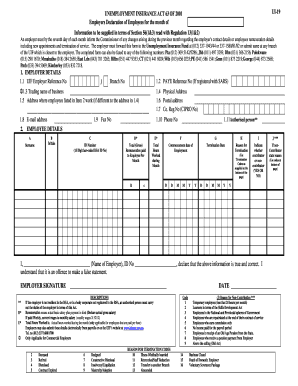

What are contributions and reasons for non-contribution?

Understanding contributions helps identify employee eligibility for various benefits. Equally important are the reasons for any non-contributions, which must be accurately documented.

-

Mark all applicable fields accurately to reflect an employee's contribution status.

-

Understand implications like loss of unemployment insurance benefits.

-

Maintaining a clear record of reasons for non-contribution helps mitigate confusion during audits.

Why is finalization of the salary schedule form important?

Finalizing the salary schedule form is crucial for ensuring that all entries are legally compliant and ready for processing. It demonstrates due diligence on the part of the employer.

-

This adds a layer of authenticity and accountability to the document.

-

Know whether to submit digitally or on paper, based on your company's policies.

-

Make certain that the final documents meet all legal standards relevant to the salary schedule.

How does pdfFiller assist with your salary schedule form needs?

pdfFiller simplifies the process of creating, editing, and managing salary schedule forms through its user-friendly platform.

-

Easily customize your salary schedule form to meet specific business requirements.

-

Quick approvals are possible through eSigning, reducing turnaround times.

-

Multiple team members can work on the salary schedule simultaneously, facilitating better teamwork.

What are common pitfalls and troubleshooting tips?

While filling out the salary schedule form, it's common to encounter errors. Recognizing these pitfalls can save time and ensure accuracy.

-

Check for omitted fields or incorrect data entries that can lead to processing delays.

-

Develop a checklist for recalibrating entries before they are submitted.

-

Resources are available, including websites and forums for assistance when facing issues.

Frequently Asked Questions about salary schedule form uif

What is the significance of the ID Number on the salary schedule form?

The ID Number is crucial for verifying the identity of the employee. It helps ensure that employee records are accurate and can protect against potential fraud.

How can I ensure compliance with South African labor laws while filling the form?

Review the latest labor laws and regulations that apply to employee remuneration. Ensure that any documentation aligns with these laws to avoid legal issues.

What should I do if I make a mistake on the form?

If you notice a mistake, it's best to correct it immediately if possible. Double-check your entries and consider if any revisions need to be documented on the form.

Can I use pdfFiller to track changes made to the salary schedule form?

Yes, pdfFiller allows you to track all changes made to your forms, ensuring that you maintain an accurate history of modifications for future reference.

What are the benefits of digital submission of the salary schedule form?

Digital submissions can speed up the processing times and reduce paperwork. They also provide an easy way to maintain records and share documents efficiently.

pdfFiller scores top ratings on review platforms